3900 was a very critical level for S&P and it has been breached. Weekly candle also shows bearish engulfing with volume, which only means we will continue to sell off. Many experts did believe we will retest June Lows - as inflation may have been peaked but it is not coming down - despite multiple rate hikes from Fed.

Next one month will be very crucial and another 10% correction is just around the corner. Although, we will technically get a good bounce - when we revisit June Lows (which incidentally will also be re-visiting 200 week moving average (EMA).

However, that bounce will just be a selling opportunity - We will most likely revisit 2020 Highs in S&P around 339 but somewhere in between 320-340 (preferably around 334) will see 2022 BOTTOM. This is also the area which showed monthly resistance at the start of year 2020 and will act as a very good support area. I do expect majority of selling off will be completed in the month of October and we will see a good bounce at the end of the year with 10 to 20% jump and close the year around 360-380 mark in SPY.

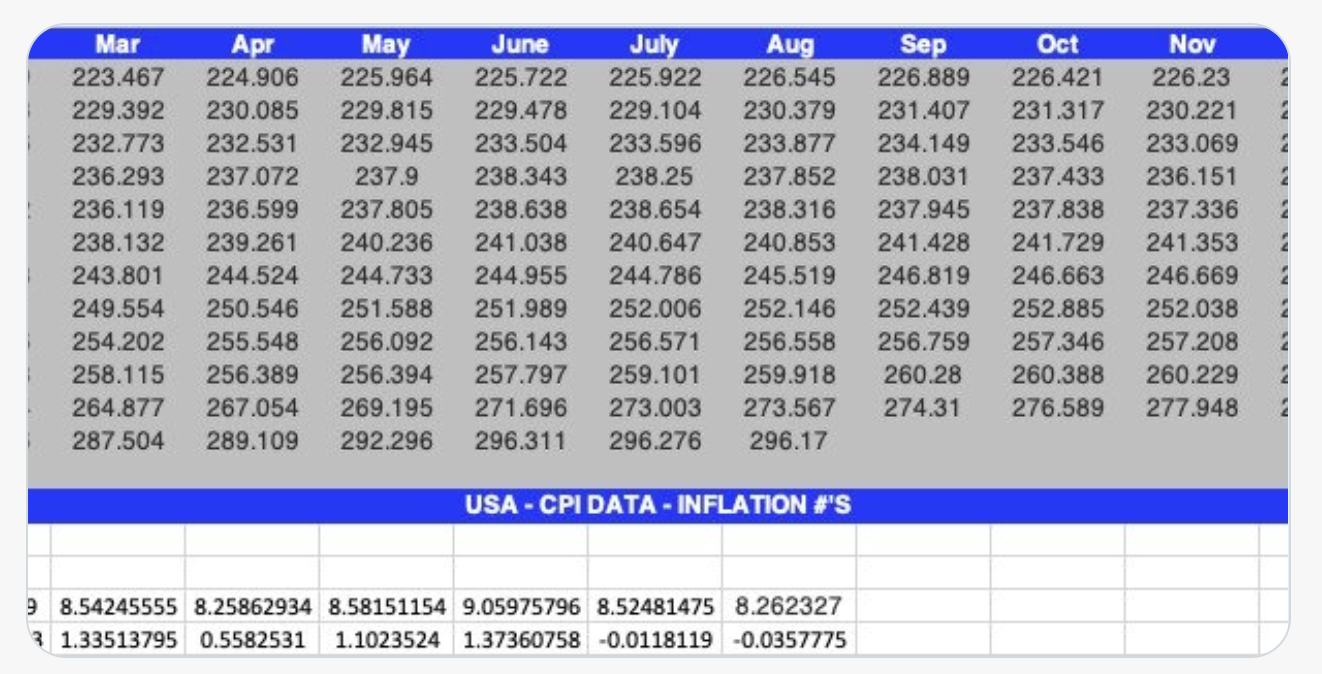

Whether 320-340 area will remain a "Historic Low" for the decade or just 2022 low - that remains to be seen and majority of it depends upon the "Inflation Data". Inflation is showing that it peaked in June (in year over year percentage wise), but it is not coming down yet and remained steady and stubborn. However MoM data does show decrease in inflation print but very marginal decrease of 0.01 and 0.03.

No comments:

Post a Comment