Saturday, December 10, 2022

Robinhood Portfolio Recurring Buying list update

Thursday, November 10, 2022

Relief Rally

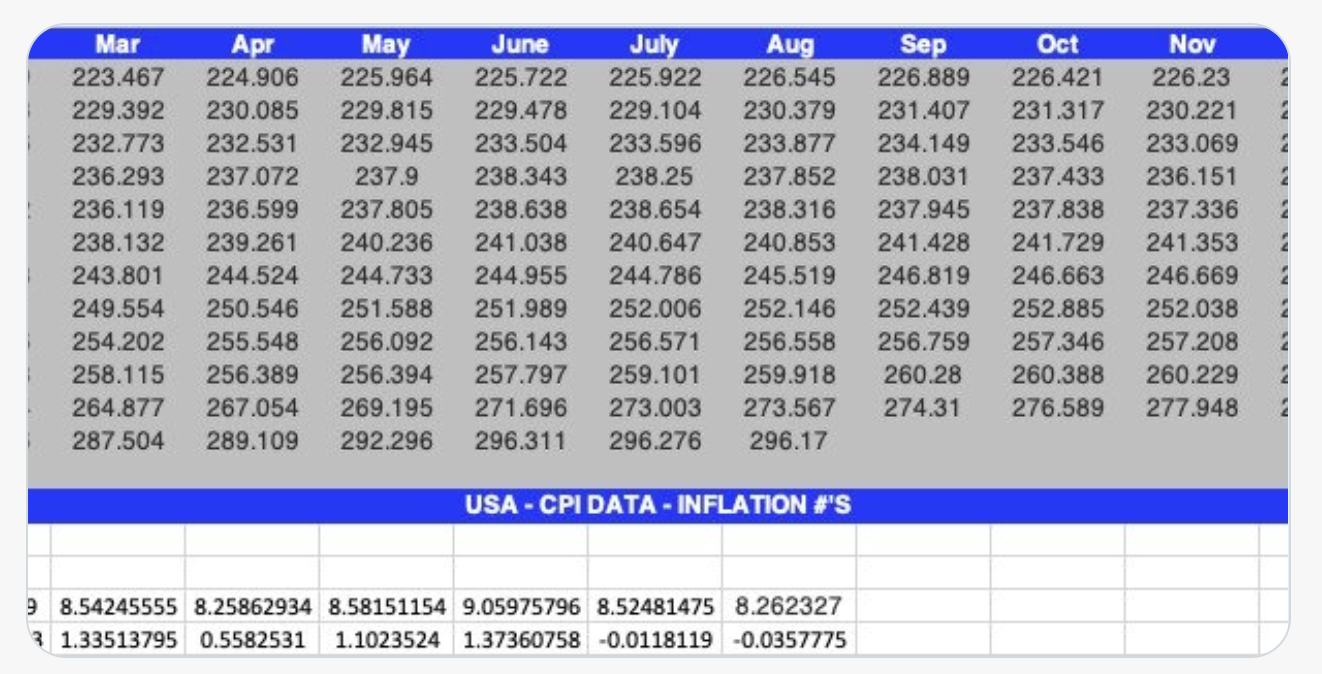

If you look at YearoverYear inflation data, then we have a Down Trend from June.

9.05% in June, 8.52% in July, 8.26% in August, 8.19% in Sep and 7.74% in Oct. 4 months in a row, inflation % has went down.If you look at MonthoverMonth data: Inflation was down from June high to July and August, but in Sep it rise 0.21% and Oct it rise 0.40%, so people can pick the data based on their bias. This seems like a relief rally, Fed will still raise rate in December (25, 50 or 75) to be decided based on other data.

Indexes are going to remain range bound, but individual stocks (based on the latest earnings they have posted), will outperform. We are still in the bear market.

Wednesday, November 2, 2022

FED RATE HIKE/CUT MOVEMENT EXPECTATION

Fed Movement Expectation: IMHO

- Raise rate 75 basis point in Nov 22 (from 3.00 to 3.75).

- Raise rate 50 basis point in Dec 22 (from 3.75 to 4.25).

- Raise rate 25 basis point in Feb 23 (from 4.25 to 4.50).

Complete QT by June 2023.

- Cut rate of 25 basis point in Sep 23 (rate from 4.50 to 4.25)

- Cut rate of 25 basis point in Nov 23 (rate from 4.25 to 4.00)

This is inline with Jackson Hole comment that rates are going to be 4% by end of 2023.

Tuesday, November 1, 2022

Random Thought

The most difficult task to master is "Unlearning what you have learned". It will take years, if not months, when people realize, "Tech Trade" is gone and "Value is here to stay"...Smart money that has moved to "Energy, Financials, Pharma, Health Insurance, Utility, Other Insurance companies (such as Progressive) etc" is not going to come out , Sure some "Tech" will work - but new decade will have new leaders. Good to "Trade" some of these tech stocks, but it might be years, before they go back to their Glory days - some may not even make it...It is a hard task to master to differentiate between , "TRADING" vs "INVESTING" mentality...

Tuesday, October 25, 2022

favorite growth stocks

30 FAVORITE GROWTH STOCKS:

- ABNB

- ASAN

- CELH

- CMG

- COIN

- CROX

- CRWD

- DKNG

- ENPH

- MELI

- NFLX

- NU

- ON

- TEAM

- TOST

- TTD

- UBER

- Z

- SE

- OKTA

- BMBL

- TTWO

- SWAV

- ETSY

- RIVN

- NET

- SNPS

- CVNA

- KRTX

- DXCM

- BILL

- FOUR

Monday, October 10, 2022

Monday, October 3, 2022

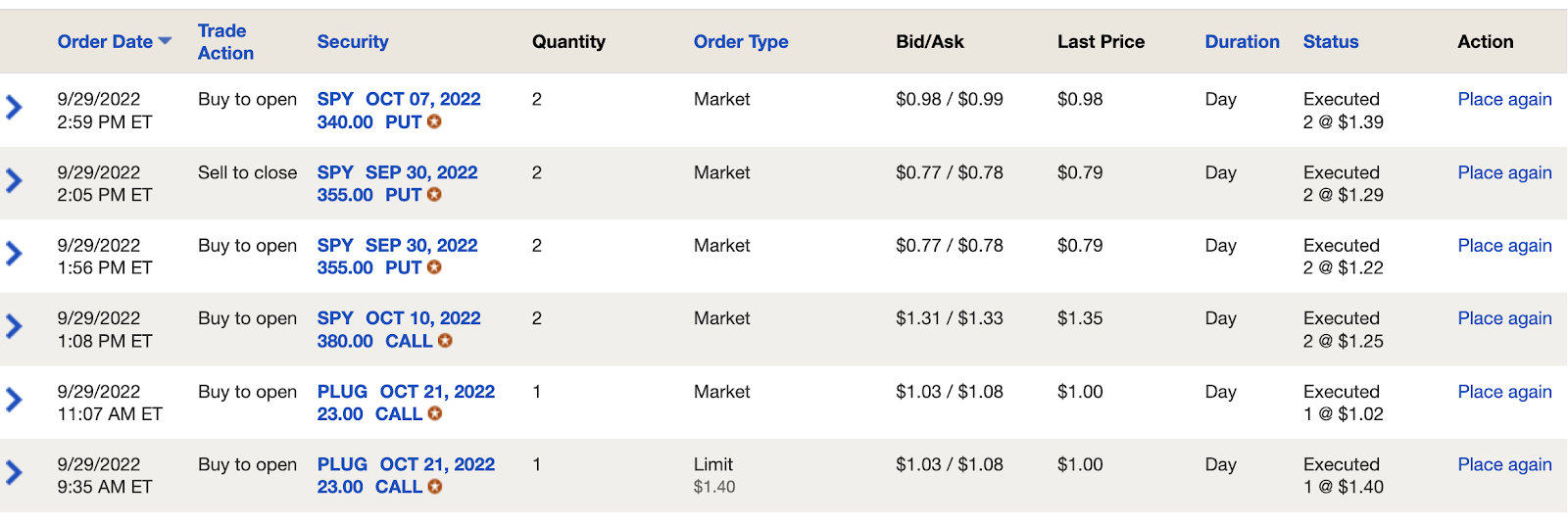

Thursday, September 29, 2022

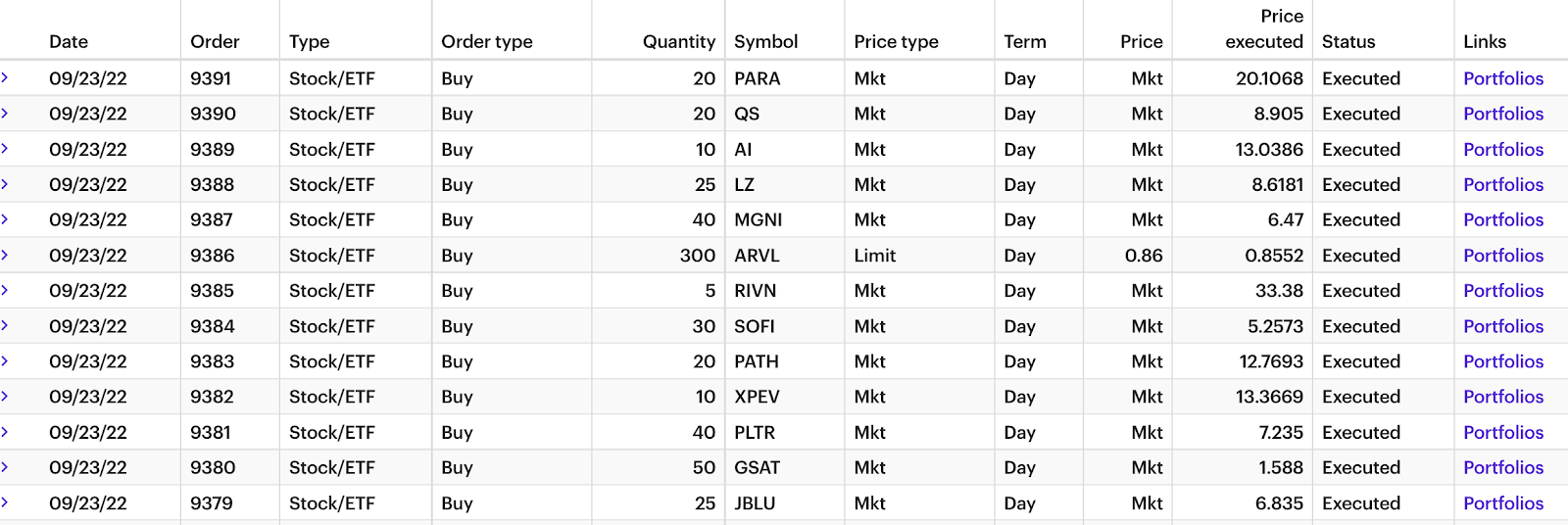

Wednesday, September 28, 2022

TODAY'S TRADES AND THOUGHTS

THOUGHTS: QQQ (Nasdaq 100) went very close to 1000 daily moving average and also in a monthly chart, it touched 50 month EMA - sort of critical levels and plus stocks were down huge in last two weeks, so oversold bounce was due. On top of it, it got Bank of England buying bonds news in the morning which created a massive rally day.

TRADES:

Bank of America:

e-TRADE:

Tuesday, September 27, 2022

Monday, September 26, 2022

Inflation vs Recession

Although conventional wisdom around FED's mandate is to control inflation over recession - there is a different point of view which needs to be addressed.

It is true that recession is fear among the poor class more - as they tend to lose jobs and it disturbs them more. Recession does impact everyone but not entirely and not as much as inflation. Inflation means price of every product and services goes up and no matter which class you belong to - you will feel the pain. In that regards, Fed is correct in addressing Inflation with higher priority even though it brings Recession.

However, the different side of Recession vs Inflation is that, common people can not fight recession on their own, however they can in a way control Inflation - by buying very limited items or only much needed items. I believe in general philosophy that, "Whatever People can do, People should do. Whatever people can not do, Government Must Do." Although - controlling inflation is not entirely government responsibility - (It is Fed's responsibility - which is sort of Government institution).

Poor and Lower middle class people can not create jobs and can not take necessary steps to come out of recession, However they can control their spending and in a way tackle inflation by reducing the demand side. So, Fed should perhaps slow down on their auto pilot mode of rate hike and let the steps they have taken control inflation - but if not slow down so that they do not bring severe recession - which they can control but people can't.

Saturday, September 24, 2022

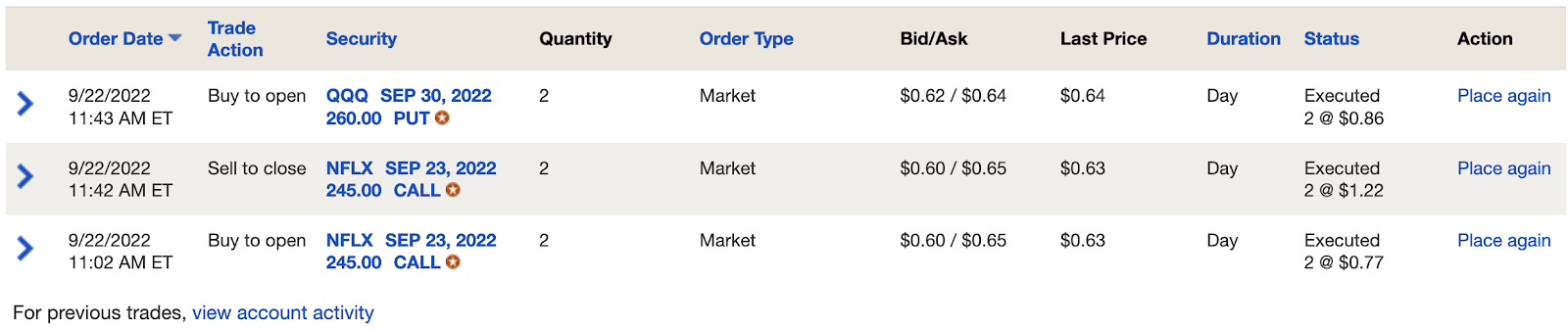

Thursday, September 22, 2022

Wednesday, September 21, 2022

Tuesday, September 20, 2022

Sep 20 Trades and Thoughts

Important day tomorrow as Fed rate hike and commentary will dictate the next turn for market. Market will be expecting 75 basis point hike and Fed to acknowledge that economy is showing signs of weakness. If they continue to stand hawkish and remain on "Auto-Pilot" no matter what until inflation gets under control, than market may see another 10-15% correction. Sentiment though is overly negative and usually when retail and many big players have put in bearish bets - market does exactly opposite. So, "Expect the UnExpected".

I would be keeping an eye on 2 year bond yield. It is fast approaching 4% and suddenly becomes attractive choice with market correcting on almost weekly basis. 4% return in current environment may be very attractive for bond buyers and if bond buyers buy 2 year bonds then yield may come down a bit. It will also indicate that Fed may raise rate and go above 4% but they will not Hold that rate for long time. Current consensus is that they will hold rate at 4% for 11 months - that time seems too high - in my opinion and that will not only bring severe recession but also stagflation. Economy may not be able to allow Fed to keep rate at 4%. First casualty may be housing market and second job market and Fed may Pivot midway or within 3 months or so after reaching 4% interest rate.

Today's Trades:

Bank of America:

- Sold SEP 23 QQQ 280 put (for no gain, no loss)

- Sold ZS Weekly 175 Yolo for 370$ (100$ Profit)

- Sold SEP 23 SPY 380 Puts for 780$ (200$ Profit)

- Sold QQQ SEP 30 270 Puts for 310$ (small profit)

- Averaged TLT DEC 115 Call for 135$

- Averaged TNDM Stocks (added to a minor initial position)

- Bought LYFT JAN 2023 20 Call for 194$

- Bought COST OCT 400 Put for 159$ (when it broke support around 497 area)

- Bought LTHM DEC 37.5 Call for 320$

- Sold MU Oct 60 calls for 100$ loss

- Bought MJ (Weed index) JAN 2025 6 call for 160$ (wanted to sell stocks to book the massive loss of 40%, but wanted a long time exposure so bought the LEAP)

- Bought OPEN JAN 2025 5 call for 170$ (same reason as above)

- Sold MJ and OPEN 100 stocks (bought LEAP Calls instead in TD AmeriTrade and created more margin balance for other opportunities - if the sell off comes)

Monday, September 19, 2022

19 SEP TRADES

BANK OF AMERICA:

- Bought ROKU SEP 23 75 YOLO @ 230$

- Averaged ROKU SEP 23 75 Yolo @160$

- Sold both ROKU Yolos for 286$ (100$ Loss)

- Bought QQQ SEP 23 280 Put for 222$

- Bought SPY SEP 21 375 Puts for 276$

- Sold SPY SEP 21 375 Puts for 90$ (200$ loss)

- Bought MMM Stocks (New Position)

- Bought SPY OCT 341 Put for 151$ (2 of them)

- Bought ROKU Stocks (New Position)

- Averaged DVN Stocks (Buying the dip in Oil/Natural Gas)

- Bought NOV YUMC 55 call for 140$

- Bought NXPI, ZS Stocks (New Position)

- Bought SEP 23 ZS 175 Yolo for 288$ (only trade that worked positive today - in a big way)

- Bought SEP 23 ROKU 76 Yolos for 266$ (2)

- Bought S OCT 30 Calls for 205$

- Added one more SPY OCT 341 Put for 136$

- Bought SEP 23 SPY 280 Put for 335$ and averaged later one more put for 235$

- Bought 2 QQQ SEP 30 270 Puts for 360$

- Bought LVS NOV 42 Call 198.

- Sold INMD, EDR Stocks (Took Profit)

- Bought EXPR, LCID and S (New Positions)

Saturday, September 17, 2022

NEW LOW IN INDEXES COMING IN OCTOBER

3900 was a very critical level for S&P and it has been breached. Weekly candle also shows bearish engulfing with volume, which only means we will continue to sell off. Many experts did believe we will retest June Lows - as inflation may have been peaked but it is not coming down - despite multiple rate hikes from Fed.

Next one month will be very crucial and another 10% correction is just around the corner. Although, we will technically get a good bounce - when we revisit June Lows (which incidentally will also be re-visiting 200 week moving average (EMA).

However, that bounce will just be a selling opportunity - We will most likely revisit 2020 Highs in S&P around 339 but somewhere in between 320-340 (preferably around 334) will see 2022 BOTTOM. This is also the area which showed monthly resistance at the start of year 2020 and will act as a very good support area. I do expect majority of selling off will be completed in the month of October and we will see a good bounce at the end of the year with 10 to 20% jump and close the year around 360-380 mark in SPY.

Whether 320-340 area will remain a "Historic Low" for the decade or just 2022 low - that remains to be seen and majority of it depends upon the "Inflation Data". Inflation is showing that it peaked in June (in year over year percentage wise), but it is not coming down yet and remained steady and stubborn. However MoM data does show decrease in inflation print but very marginal decrease of 0.01 and 0.03.

Consolidated Portfolio update

On, June 16, 2022 (which I still considered to be the bottom of this bear market - until proven otherwise), I selected the list of 30 stocks and created a consolidated portfolio. 3 Months down the road, there are some failures and there are some huge success. Here is the update from this list (https://viralpatel15.blogspot.com/2022/06/m1-finance-to-consolidated-portfolio.html)

SE, HZNP, DPZ, BIDU are three failures and FDX joins that list today.

Consolidated portfolio is up 18% compare to SPY/QQQ which are up 6%.

Replacing some of the failures and introducing new stocks to this list.

Some of them are one on one replacement such as Dominos is being replaced by Chipotle. Lam Research is replacement by ON semi conductors. BIDU (Chinese exposure) is replaced by IBN (ICICI - Indian Bank), SE (Singapore exposure and gaming stock) is replaced by TEAM (Australia exposure) etc. Added some exposure in DVN (Oil and Natural Gas), some defense MOH (Health care stock), COIN (Crypto exposure), RUN (Solar Energy), NU(replaces UPST - Fintech stock from South America), SNOW (replaces MDB), SRPT (Biotech replacement for HZNP), TTD (replacing TTWO - gaming stock to advertisement).

I will track their performance on quarterly basis and may replace few things based on their performance some time in Mid-December- 2022

New list of stocks are:

- ABNB

- ASAN

- AXP

- BAC

- CELH

- CMG

- COIN

- COST

- CROX

- CRWD

- DKNG

- DVN

- ENPH

- FND

- IBN

- MAR

- MELI

- MOH

- NFLX

- NU

- ON

- RUN

- SBUX

- SNOW

- SRPT

- TEAM

- TOST

- TTD

- UBER

- Z

Friday, September 16, 2022

16 SEPTEMBER TRADES

Bank of America:

- Bought AA SEP 23 44 call for 126$

- Bought 10 AA SEP 43 Calls for 130$ and sold for 60$. Minor loss.

- Averaged AA SEP 23 44 Call for 95$

- Sold AA SEP 23 44 calls for 146$ (for minor loss)

- Bought TLT DEC 115 call for 187$

- Sold CLF Stocks.

- Bought 3 MU OCT 60 Calls for 246$

- Bought MU, INTC, FUTU, VALE Stocks (New Positions)

- Averaged BMBL position by buying more stocks.

- Sold VIPS Stocks (Reducing china exposure)

- Sold MANU Stocks (Rumor about buyout did not pan out)

- Sold POSH Stocks (took profit)

- Bought more RDFN stocks (some of the housing related stocks are cheap buy)

- Sold FUTU Stocks (bought at TD Ameritrade to free up some margin balance)

- Sold ONON stocks (Keeping FTCH in the same space)

- Bought DHT Stocks (adding oil exposure)

- Sold BOX stocks (Inv H & S didn't work)

Thursday, September 15, 2022

15 SEPTEMBER TRADES AND THOUGHTS

THOUGHTS ON MARKET:

S&P 500 keep getting saved around 3900 area and that resilience can be attributed to Friday’s $3.2 trillion option expiration. Quadruple witching day - tomorrow - which means majority of the movement in stocks or indexes happens based on maxpain area. It is highly recommended to remain very light in options exposure around those days as movement on both sides can be very nasty. We will see the real movement next week - on or before Fed meeting.

TRADES:

Bank of America:

- Bought and Sold TLT SEP 23 110 Calls for a minor 10$ loss.

- Sold CLF calls for a minor 30$ loss.

- Sold NOV STX 67.5 call for a 100$ loss.

- Sold TLT Oct 113 calls for a minor 20$ loss.

- Sold DVN Oct 80 calls for a no loss-gain.

- Sold ALT Oct call for a major loss (200$ loss)

- Bought BOX, LU and POSH (New Positions)

- Sold STX (stocks) for a minor 20$ loss and took profit on TNK stock.

Wednesday, September 14, 2022

14 SEPTEMBER TRADES AND THOUGHTS

THOUGHTS ON MARKET:

Consolidating and choppy day at the market. Market is trying to digest the higher inflation print from yesterday. PPI # came as expected and since FED is in the blackout period, market is unsure how to read the slightly higher inflation print. Oil was down 10% in the inflation report but Food and elsewhere there was higher inflation. But will that prompt Fed to raise the rate 1% instead of 75 basis point? that remains to be seen. Tomorrow's jobless numbers will give some sort of idea - as if there are more people losing job - than Fed may not want to be aggressive as inflation was just slightly higher than anticipated move. Plus rate hikes have happened very recently, so Fed may want to give time to see whether it is making any effect on inflation or not.

In my opinion, Fed will raise only 75 basis point hike next week and market should be able to digest the bad news from inflation.

TRADES:

Bank of America:

- Sold CMP Calls for a minor loss.

- Averaged TLT SEP 109 Calls (5) for 115$ and sold all the TLT calls for a minor profit for 310$.

- Bought SPY SEP 387 Put for 140$ at 1.40 PM and sold it for 180$ at 1.50 P.M. (Quick 10 minute - 40$ profit trade)

- Bought 5 SEP 23 CLF 17 calls for 95$. (#CLF near 200 week ema support)

- Sold TNK Jan 2023 30 call for good profit.

- Sold KWEB Nov 32 calls for a small loss.

- Bought STX NOV 67.5 Call (STX was forming double bottom in daily chart)

- Sold CVNA, DKNG and RIVN covered JAN 2025 calls and collected 4000$ in premium.

- Sold BIDU (Stocks) - after holding and averaging for months. After HZNP and DPZ this is the third stock which is part of my favorite 30 stocks - so very sad to sell them for minor loss.

- Averaged META and BYD (stocks)

- Bought CMCSA stocks (New Position) - they announced buyback and at a reasonable valuation.

- Bought very small new position in TNDM. (If it goes down, will average later)

- Bought IBN (New Position) - Indian bank ICICI - making new highs almost each week.

- Bought CLF stocks (big new position), as it is near 200 week ema support.

- Sold ALT as it opened 50% down. Took 40% loss in overnight swing.

- Sold ANGI, EDU, CLOV, SBRA, PARA (minor to big losses) - cutting the losers - increasing margin to buy winners or new positions.

- Averaged position in USER (now have almost full position)

- Bought STX and PLUG (New Positions).

Tuesday, September 13, 2022

13th of SEPTEMBER SELL OFF RECAP

THOUGHTS ON MARKET:

S&P 500 CLOSES 4.3% LOWER IN WORST DAY SINCE JUNE 11, 2020. Nasdaq closed more than 5% down as we got a surprise rise in inflation data in the morning. Anything above 8 was a bad news but 8.4 which is higher than July #'s really tanked the market. As it puts the question mark whether we saw inflation peak in June or not. We are in the blackout period from Fed - which means, we will not know how Fed is going to react to this and that puts uncertainty in the market - which is never a good news. Market awaits PPI Data tomorrow morning and we may get a minor dead cat bounce.

TRADES:

Bank of America:

- Bought 1 SPY 395 SEP 14 Put - for 101$ and Sold for 239$.

- Averaged TLT SEP 109 Calls (3) for 63$

- Bought 1 SPY 380 SEP 30 Put - for 220$ and Sold for 460$.

- Bought 1 ALT OCT 28 Call for 195$

- Sold C Jan 2023 57.5 Calls for minor profit.

- Sold LYFT Jan 2023 20 call for 60$ loss.

- Sold FUTU Jan 2023 85 calls for a minor loss.

- Bought 1 DVN Oct 80 Call for 146$

- Sold BIDU Jan 2023 220 Calls for 100$ loss

- Sold WOW NOV 20 calls for a minor loss.

- Bought TLT OCT 113 Calls for 156$

- Sold SNOW, PTON, CMP, GS, KKR, NKE for losses.

- Sold GLD, TWLO, TSLA (25% position), CRM, JCI, COIN for profit.

- Sold CHWY, BYND, TDOC, SKX, FCEL, LAZR, LZ, AAL, DH, SMCI, WOW.

- Bought PUBM, ALT (New Positions)

SEP 12 Trades and Thoughts on Market

THOUGHTS ON MARKET:

Very very critical inflation numbers are due tomorrow morning. Anything over 8% inflation will be bad news for market, but less than 7% will confirm June Lows.

TRADES:

Bank of America:

- Bought 2 CMP SEP 42.5 Calls for 190$. (breakout yolo)

- Bought and Sold SPY Puts in a day trade for 170$ and sold for 140$ (minor loss). SEP 14 400 Puts.

- Bought TLT SEP 109 Yolos. (Bonds made another 52 week low today) - expecting a bounce sometime this week.

- Sold remaining 3 DKNG OCT 17.5 Calls for huge profit.

- Sold TWLO OCT 85 Calls and took the 100% Profit.

- Sold NKE SEP 23 115 calls and took profit (100+$)

- Sold SPY DEC 450 call and took profit (100$)

- Sold DIS Oct 14 124 Calls and took profit

- Sold RIVN SEP 37 Yolo (in the money) and took 100%+ Profit

- Sold CZR OCT 55 call and took minor profit.

- Bought LYFT JAN 2023 20 Call for 242$

- Bought CMP @ 41.60$ (New Position)

- Bought SNOW @ 192 (New Position)

- Sold AEHR (took profit)

- Bought LAZR (New Position)

Friday, September 9, 2022

SEPT 09 2022 TRADES

TRADES:

Bank of America:

- Bought NKE SEP 23 115 Calls for 88$ each.

- Sold half of DKNG OCT 17.5 calls to reduce risk.

- Sold TWLO SEP 72 calls to reduce risk (breakeven trade) - still keeping Oct Calls.

- Sold META 175 SEP calls (break even)- Sold META 170 SEP Calls (big profit)

- Bought CZR Oct 55 call for 155$ (Casino's looking good)

- Bought RIVN SEP 37 Calls for 108$ each.

- Bought WOW NOV 20 Call for 160$.

- Sold LYV, VZ

- Bought NKE, WYNN (New Position)

- Sold GLD JAN 2024 20 Calls for profit.

- Sold SEAS for Profit - bought for 50$, sold for 55$ small time frame, small trade.

- Bought RIVN, WOW, SKX, FCEL (New Positions)

Thursday, September 8, 2022

SEPT 08 2022 TRADES & THOUGHTS ON MARKET

THOUGHTS ON MARKET:

A very volatile day, but rally continues despite negative news from England where rate was raised by 75 basis point. However rally seemed defensive in nature - where Healthcare and Financials outperformed. Powell reiterated similar comments and despite market ended Green displaying negative news is priced in. Market is also waiting on big inflation print next week. We are still not out of the woods, but there are glimpses of clear light and road ahead. We could be in for 20% up or down in next 3 months, so have to watch market very closely.

TRADES:

Bank of America:

- Averaged DIS SEP 118 Call.

- Bought TNK JAN 2023 30 call for 170$

- Bought SPY DEC 450 Call for 205$

- Sold IQ Jan 2024 5 calls and took the minor loss.

- Bought DB @ 8.60 (New Position)

- Averaged ZIM @ 30.55

- Sold BILI, DQ, IQ and WBD stocks.

- Averaged FUTU, GSAT, XPEV, BZUN

- Bought TNK, MTTR, RIVN (New Position)

Wednesday, September 7, 2022

SEPT 07 2022 TRADES & THOUGHTS ON MARKET

THOUGHTS ON MARKET:

Finally a day - when market opened red and we saw huge rally. Roy's prediction shared in earlier blog came true, we rally from 390. Also last week, huge amount of puts were being bought as part of the hedge from institution - like 8 billion worth so last half was more like squeeze.

Oil dropping also helped the cause - as it reduces inflation. Plus, Beige book showed American Economy showing signs of weak - that added the confirmation.

Tomorrow Fed Chairman Powell speaks and also job numbers.

TRADES:

Bank of America:

- Bought DIS SEP 118 Call.

- Sold DVN OCT 85 calls for a loss.

- Bought KWEB NOV 32 Calls for 116$ each.

- Bought META SEP 170 Calls for 112$ each.

- Bought a FLEX APR 2023 20 Call for 165$

- Bought PANW @ 531 (New Position)

- Added BMBL @24 and FDX @200 to existing position.

- Bought AAPL @155 (New Position)

- Averaged position in SKLZ

- New position in BILI, BYND, AEHR, FLEX, GSAT.

Tuesday, September 6, 2022

SEPT 06 2022 TRADES & THOUGHTS ON MARKET

THOUGHTS ON MARKET:

Range bound - choppy session; Market is awaiting Fed Chairman Powell to speak on Thursday - to clarify on his remarks at Jackson Hole. My guess is - he will reiterate most things he said however he will clarify that Interest Rates around 4% by end of 2023 depends upon data. If Inflation gets controlled before that and economy is in recession, they may ease earlier. Market is waiting for that plus inflation data next week, before moving higher.

TRADES:

Bank of America:

- Sold TWLO SEP 9 80 calls for a massive loss. (very bad trade)

- Bought ON SEP 72 Calls.

- Averaged META SEP 175 Call for100$

- Bought BIDU JAN 2023 220 Calls for 200$

- Bought TWLO OCT 85 Calls for 270$

- Averaged IQ JAN 2024 5 Call for 90$

- Bought C JAN 2023 57.5 Calls for 200$

- Bought FUTU JAN 2023 85 Calls for 190$

- Sold QQQ SEP 14 276 Puts for minor profit.

- Sold COST SEP 480 Put for minor profit.

- Bought more ON, TLT, SE, COST, BIDU (added in existing position)

- Bought CRM (new position) @ 152$

- Bought C (new position) @ 48.35

- Averaged position in LYFT, BZUN, FUTU, REAL.

- New position in CCJ, EDR and DH.

- Sold position in MNMD (20% rule triggered), BORR

Friday, September 2, 2022

Thoughts on Market

Apparently, Good news was bad news for Market. Good job numbers means, Fed can raise 75 basis point in September meeting - if required. Market ended with daily chart displaying, "Bearish Engulfing" with volume also more than yesterday. Tuesday open - even if we open green - will remain weak. Market closed right at the trend-line from where it can bounce.

There is also another fear in the market as western countries trying to impose price structure for Russia to sell their oil. Russia may retaliate - by cutting the oil supply - increasing the price of oil - a big threat to inflation #.

However, things will largely depend upon Inflation #'s from August and if we continue to slide further and show up numbers which were right around May #'s - that will be big positive for market. Any number above 8% - will be bad news for market and we may very well revisit June Lows.

Its a coin toss - about Inflation so I remain "Cautiously, Optimistic".

September 2, 2022 Trades

Bank of America:

- YUMC SEP 50 CALL -closed it for a loss.

- V 200 YOLO - bought and closed it for a minor loss.

- UAL 36 SEP 9 Calls - closed it for a loss.

- Bought LULU stock (based on better guidance for 326)

- Bought MATV stocks.

- Added my position in DVN, OXY (oil stocks) -

- Bought QQQ Sep 14 - 276 Puts (Hedge) - in case of bad inflation print next week.

- Bought COST Sep 480 Put (Hedge) for my position in Costco - in case of bad inflation print next week. may close early next week and book profit.

- Closed NKE SEP 23 116 Calls for a loss (reducing near time exposure)

- Bought FB SEP 175 Call for 120$ (if market RIP on a below 7% inflation print - META since it is oversold - will have better up side).

Thursday, September 1, 2022

Today's Trades

BANK OF AMERICA:

- SOLD UAL 36 YOLOS (MISTAKE) FOR A BIG LOSS

- BOUGHT MORE TWLO 80 CALLS FOR NEXT WEEK

- BOUGHT UBER SEP 30 CALLS.

- BOUGHT UAL NEXT WEEK 36 CALLS.

- MOH

- OKTA

- TWLO

- TTD

- GOLD

- MNDY

- DAL

- GRMN

- SE

- ON

- SPG

- NVDA

- VEEV

- MELI (half position)

- WYNN

- SMG

- QYLD

- RYLD

- XYLD

- DPZ

- VICI

- TWLO SEP 72

- DVN OCT 85

- IQ JAN 2024 5

- DIS OCT 124

- REAL

- JBLU

- ANGI

- IQ

- AAL

- RDFN

Wednesday, August 31, 2022

AUGUST 31, 2022 UPDATE

31 AUGUST 2022 UPDATE:

BANK OF AMERICA:

- SOLD PARA CALLS FOR NO GAIN/NO LOSS

- SOLD CRWD PUTS FOR A LOSS

- BOUGHT AND SOLD QQQ PUTS FOR A 100% PROFIT (DAY TRADE)

- SOLD WMT CALLS FOR NO GAIN/NO LOSS

- AVERAGED UAL 36 CALLS YOLOS

TD AMERITRADE:

- BOUGHT DVN OCT 85 CALL FOR 138$

- BOUGHT 2 DKNG OCT 17.5 CALLS FOR 254$

- BOUGHT 1 TWLO SEP 72 CALL FOR 295$

- BOUGHT FDX @ 211, NVDA @151, KKR @50.71, CRWD @179

- CLOSED COVERED CALL POSITION IN BBBY; SOLD INTC STOCKS

- BOUGHT NKE SEP 23 116 CALLS FOR 82$ EACH

ETRADE:

- SOLD TWLO WEEKLY 75 YOLOS FOR A LOSS

- SOLD AMBA, WEBR STOCKS FOR LOSS.

- BOUGHT SEAS (STOCKS) @ 51.25

BIG GAINERS: CHPT, UPST

THOUGHTS ON MARKET: CHOPPY, HUMP DAY ACTION. MARKET IS STILL TRADING BASED ON LAST FRIDAY COMMENT FROM POWELL ON 4% INTEREST RATE RUNNING TILL END OF 2023. MARKET HAS TO WAIT FOR JOB NUMBERS TO PUT A DENT IN FED WISH LIST. IF UNEMPLOYMENT THREATENS TO GO ABOVE 5% AND INFLATION COMES UNDER 7% - MARKET WILL OVERLOOK FED’S COMMENT AND CONTINUE WITH THE YEAR END RALLY. HOWEVER IF JOB #’S ARE STRONG AND INFLATION STILL HIGH - THATS BAD NEWS FOR MARKET. MARKET IS STILL RANGE BOUND - IN MY OPINION. FROM 362 TO 431 WE WERE OVERBOUGHT ON AUGUST 16, BUT FROM 431 TO 396 - WE ARE COMING IN THE TERRITORY OF OVERSOLD AND A BOUNCE IS DUE EITHER THIS FRIDAY (AFTER JOB REPORT) OR NEXT WEEK.

Thursday, June 16, 2022

M1 Finance to Consolidated Portfolio

This week - I liquidated three of M1-Finance portfolio to consolidate investment into the following 30 hand picked stocks for longer term duration.

30 Stocks picked are:

- BAC

- COST

- AXP

- SBUX

- NFLX

- ABNB

- LRCX

- FDX

- MAR

- SHOP

- BIDU

- UBER

- SE

- CRWD

- MELI

- ENPH

- MDB

- HZNP

- OKTA

- DPZ

- TOST

- FND

- Z

- DKNG

- BMBL

- CELH

- ASAN

- UPST

- CROX

- TTWO